Remember how Citibank revolutionized the banking sector in the 1970s as one of the first U.S. banks that introduced automatic teller machines (ATMs), giving 24-hour access to cash for its customers.

This subtle example shows the importance of technology and its role in bringing critical changes to the financial services and banking sector. In this modern world, IoT (Internet of Things) is changing the nature of banking itself.

According to MarketsandMarkets, the market size of IoT in the financial and banking industries is expected to reach over 2 billion USD by 2023.

This is the age of global digitalization in the financial sector, and we will be explaining the revolution IoT is bringing to banking and financial services.

How does IoT in finance work?

With billions of devices connecting and creating a grid of intelligent systems, shared data are abundant. Once these devices start transmitting data on the cloud and analyze it, financial institutes can use the information to transform their services.

When consumers use their smart devices, they use and compile data. Banks then use this data to get a real-time view of customers’ finances. With the financial data in hand, banks tailor their financial services as per the customers’ needs.

The banking of things has become a powerful facilitator for increasing customer loyalty and bringing more business.

Banks can connect to their customers and communicate with them via smartphone devices. The same tool monitors their overall customer spending habits and then enables banking institutions to provide financial advice and create other tailored services.

1. Asset monitoring made smarter

With IoT in the fintech environment, banks can

- maintain equipment

- assess branches’ asset use

- enhance decision-making quality while providing loans

- become more efficient in improving risk management

We are listing a few potential uses of IoT in banking for asset monitoring:

- Collect ATM usage data to ensure peak efficiency.

- The Internet of Things will collect information regarding the device.

- Gather and process client data for pointing out pain points and provide better services.

- Collect real-time market fluctuation data for smartly increasing the bank locations.

- Enhance IoT security issues.

- Improve borrowers’ activity and quality of collateral monitoring.

All of this can be done by collecting high-volume data and merging big data analytics with AI systems. Smart banking asset monitoring will improve client retention rates and also massively cut down branch operating costs.

2. Better and faster customer insight

With a customer-centric approach that businesses are pursuing in this modern age, providing a personalized experience to customers has taken center stage. This experience enables creating loyalty amongst the current customer base while maintaining a nice influx for the new ones.

By introducing the Internet of Things, banks will be able to get better insights into their clients’ and debtors’ behavior. Let us see a few practical benefits of collecting consumer insights using IoT systems:

- Check creditors habits for precise evaluation of their creditworthiness.

- With real-time customer data, consultants can increase the quality of their customer support with faster and on-point service delivery.

3. Quick payments using wearable smart devices

With wearables in the mix, IoT will have a much deeper impact on the banking industry. Using wearable technology, banks can allow their customer base to experience faster bill payments and a more secured transaction.

Let us look at the potential ways the banking sector can leverage wearable technology:

- With IoT devices in place, the clients can get financial announcements directly on their wearable devices.

- Banks can use these devices for creating a meaningful connection with their customers and increase brand visibility.

- Soon smart wearable devices will replace Google or Apple-based transaction apps.

Tech giants like Google has introduced payment feature in its wearable device. Customers who already own Google Wear OS, can do their banking transactions in the US, Canada, UK, Australia, and Spain.

4. Implementing advanced fraud detection

For the past couple of years, the news of hackers breaching security of big companies has been the center of news stories. The reliability of businesses upon traditional security systems has seen declining mistrust. In the modern age where businesses deal in data, financial institutions are now heavily making investments in securing their clients sensitive data.

Banking and financing institutes can skilfully use the Internet of Things for detecting security breaches and block the hacked accounts in a timely fashion.

Let’s take a practical example here.

By using an IoT-system, banking institutions can gather important user data and analyze the activity. Now, they can transfer this user data to the cloud and match it against the user’s traditional spending patterns to find any inconsistency. In an event of malicious activity being discovered on the users account, the bank can alert the client while their account is disabled temporarily. Citibank and British Standard Chartered are amongst the pioneers in implementing advanced fraud detection systems to safeguard their customer accounts by investing in AI and IoT-based cybersecurity solutions.

5. Improving investments and capital market visibility

For investment sector it is important to track the real-time state of the market for improving their decision-making process regarding revenue-critical investments. Internet of Things will play a vital role in this regard and help the capital market in:

- Gather real-time data for better investment assessment

- Display autonomous trades

- Generate faster trading strategies, ideas, and tailored recommendations

6. Providing quality customer service

By implementing the Internet of Things, banking and financing institutions can use the customer data for predicting their customers need for financial aid.

Here are some instances where IoT can play a crucial role in banking:

- In a bank with limited staff and mandatory queue, while observing social distancing, IoT devices can guide the client by notifying them about an available counter.

- IoT devices can send various other data to the client's wearable or smartphone device upon arrival at the bank or a particular counter.

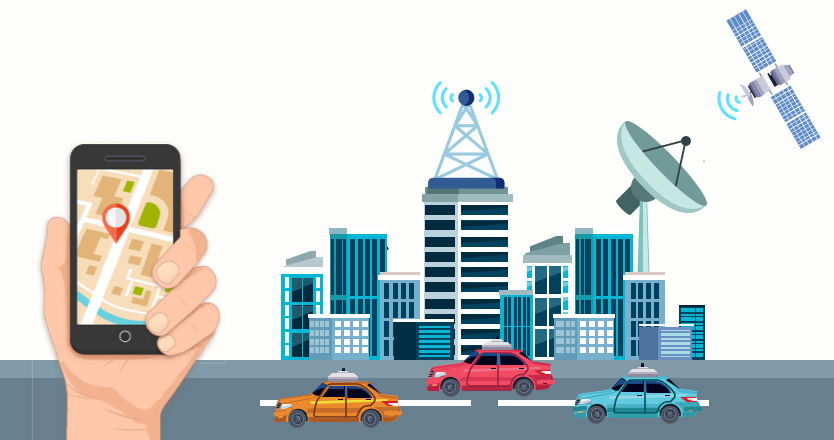

- With the help of a beacon-based system, banks can redirect the clients to the nearest branch or help customers find the nearest branch in their area.

- Branches can share user data amongst themselves at a much faster rate for providing instant and personalized experiences across all locations.

- Banks can use beacon and IoT devices for enhancing their security using biometric systems.

- IoT devices can allow banks to start operating with a minimum workforce.

With the help of connected devices, businesses are already improving their customer service and bringing automation to their overall business process.

The current state of IoT

If you want to know more about the IoT market to determine if it's just a facade or it can get implemented in the system. These statistics will highlight the consistent pace at which financial services are adopting IoT. Let us take a few insights into the current state of IoT market.

- Around 2025, the economic impact of IoT will reach 11 trillion dollars.

- As per Statista report, the worldwide base of connected devices for telecommunications is around 75.44 billion units.

- In the private sector, based on the data provided by Statista, companies are expected to bring in over $863 billion by 2025.

With these numbers, it is evident that Internet of Things in the banking sector will become a worthy investment for the financial companies. Though financial institutions have not completely accepted this disruption, the coming years will see more utilization of this technology.

Concluding statement: IoT devices are stirring up disruption in various sectors

Our hope is that this article will help you in creating an exact roadmap for the disrupting traditional systems you have been using in your financial organization.

Rapidops enables businesses to carry out disruption in their business process using IoT-enabled devices. Do check out the assorted services we provide to businesses worldwide. If you want to partner with a digital product development expert, then let's sit down for a discussion and plan out IoT disruption.

Let’s build the next big thing!

Share your ideas and vision with us to explore your digital opportunities

Similar Stories

- Trends

- undefined Mins

- May 2021

- Trends

- undefined Mins

- April 2022

- Trends

- undefined Mins

- March 2017

Receive articles like this in your mailbox

Sign up to get weekly insights & inspiration in your inbox.