While a recession is not yet underway, many business leaders are preparing for the possibility of one in 2023 by developing contingency plans to mitigate the potential for any negative impacts on their businesses.

While the prospect of an economic downturn or recession can be daunting for businesses of all sizes, with the right strategies and tools, it's possible to navigate tough times and even emerge more assertive on the other side.

Preparing for a recession could include reducing costs, streamlining operations, diversifying revenue streams, and securing additional funding. Businesses must also stay current on market trends and closely monitor economic indicators to respond quickly and effectively to any changes in the business environment.

Data and analytics are among the most powerful tools a business can use. In this article, we'll cover the primary ways you can leverage both to survive and thrive in an economic downturn.

What can business leaders do to weather the “recession storm”?

I firmly believe that, in these times, for most businesses, pursuing digitalization is your only choice if you want to succeed. - Dr. Ram Charan

Recessions are tough on everyone, and that includes business leaders. Even tech companies, which weathered the pandemic's storm relatively easily, are now laying off employees en masse.

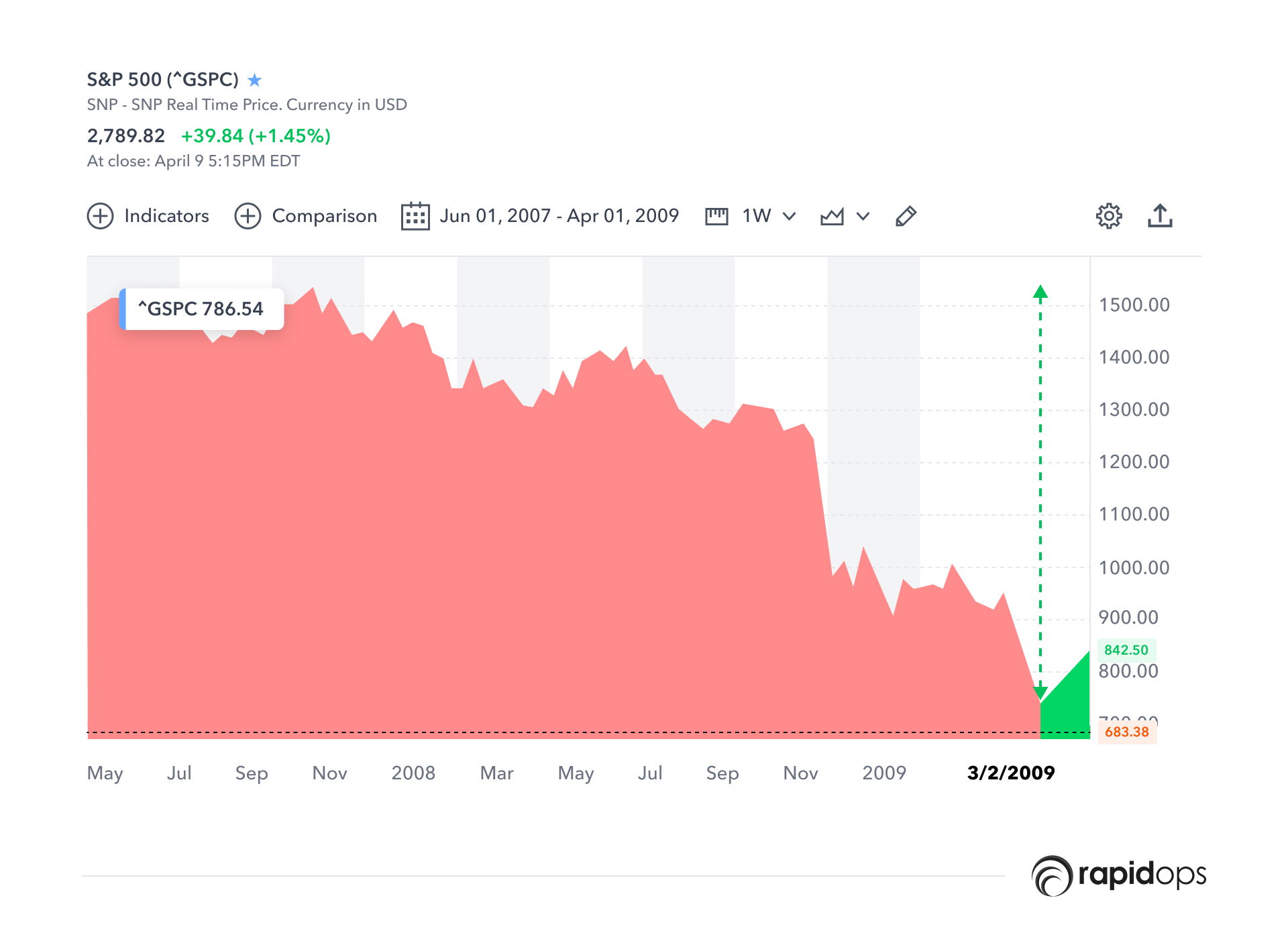

But here's the good news: historical data and analytics show that we always bounce back stronger after every recession. While it may be difficult in the short term, recessions are a natural part of the economic cycle.

In the first quarter of 2009, which marked the recession's lowest point, more than 230,000 businesses in the United States were forced to shut down, as the US Bureau of Labor Statistics reported.

Using data prediction models to monitor recession indicators

Data prediction models can be extremely valuable to businesses during a recession, as they can provide insights that inform strategic decisions and help mitigate the negative impacts of economic downturns. With the correct datasets, businesses can anticipate market shifts, respond quickly to changes in demand, and optimize operations.

1. Predicting customer behavior

Analyzing customer behavior can help business leaders predict how consumers may react during a recession. For example, analyzing customer buying behaviors can help determine which products or services will be in higher demand and when.

Business leaders can use that information to adjust their inventory or marketing strategies, identify which customers are likely to reduce their spending and focus on retaining those most likely to continue making purchases.

2. Forecasting demand

Businesses can predict future product or service demand using data on past sales and market trends. This can help them adjust their production and inventory levels to meet expected demand, avoiding excess inventory costs or lost sales due to stockouts.

3. Managing cash flow

By analyzing data on cash flow, businesses can identify areas where they can cut costs or optimize spending. They can also use predictive models to forecast future cash flows and plan accordingly.

4. Identifying potential risks

Business leaders can identify potential risks by analyzing past data and developing mitigation contingency plans. For example, they can identify suppliers at risk of bankruptcy and create alternative supply chains.

5. Improving efficiency

Analyzing operational data, businesses can identify areas to improve efficiency and reduce costs. This can include optimizing supply chains, improving production processes, and reducing waste.

Unleash the Full Power of Your Data With Our Expert Techniques and Insights.

Download Now

Practical strategies to navigate the murky waters of recession with data and analytics

In today's economic climate, businesses must be strategic and data-driven to thrive. By leveraging the power of data analytics, business owners can navigate the challenges of a recession. Here are six key strategies that we can help you implement:

1. Diversify your offerings

When the economy takes a hit, some industries are hit harder than others. Diversifying your offerings can help to mitigate the impact of a downturn. If one aspect of your business experiences a decline, you can rely on other areas to sustain the business.

For example, a restaurant that offers dine-in, takeout, and catering services can pivot its focus to the latter two during a recession, when fewer people may be dining out. Another example could be a clothing store that expands its product line to include accessories or home decor items to appeal to a wider range of customers.

2. Stay flexible

Staying flexible and adaptable is crucial to surviving economic uncertainty. Pivoting your business strategy in response to changing market conditions can help keep your business afloat.

Amazon is well-known for its flexibility. The company has adapted its business model multiple times, starting as an online bookstore and now offering a wide range of products and services. Amazon adjusted its operations during the pandemic to prioritize essential items and implement employee safety measures.

3. Focus on customer loyalty

Customers who trust your brand and believe in your products or services are likelier to stick with you even in tough times.

For instance, Patagonia, an outdoor clothing and gear company, has built a loyal customer base by embodying its core values of environmental sustainability and ethical business practices. Its customers see Patagonia as a clothing brand and a movement they want to participate in. This has led to high customer retention, with customers promoting the brand independently.

4. Build a cash reserve

A cash reserve is important for any business, but it's especially crucial during a recession. Building up a cash reserve can help weather economic downturns and keep your business afloat.

One example of a company with a significant cash reserve is Apple. The company has a cash hoard of over $269 billion, which has helped it weather economic downturns and make strategic investments. Building a cash reserve can also be important for small businesses, as it can provide a cushion during lean times.

5. Cut unnecessary costs

During a recession, every penny counts. Cutting unnecessary costs can help keep your business financially stable. Look for ways to streamline your operations and eliminate unnecessary expenses.

A good example of a company that has successfully cut costs is Ford. In 2008, during the recession, the company implemented a restructuring plan that included layoffs, plant closures, and a focus on more efficient operations. These measures helped the company to cut costs and return to profitability.

6. Embrace predictive analytics

Predictive analytics can be a powerful tool for anticipating market trends and identifying opportunities for growth during a recession. By analyzing data from multiple sources, business leaders can gain insights into emerging market trends and make informed decisions about where to invest their resources.

During the 2008 recession, the home improvement retailer Lowe's used predictive analytics to identify which customers were most likely to cut back on their spending due to the economic downturn.

By analyzing purchasing data and demographic information, Lowe's developed targeted marketing campaigns aimed at these customers, offering them promotions and discounts to keep them engaged with the brand.

As a result of these efforts, Lowe's maintained its sales volume during the recession, while its competitor, Home Depot, saw a decline in sales. Lowe's achieved this by using predictive analytics to anticipate changes in customer behavior and adjust its marketing strategy accordingly, rather than relying on a "one size fits all" approach.

Understanding the relation between inflation and recession

Inflation and recession are interrelated, as inflation can decrease spending and contribute to a recession. Similarly, a recession can cause prices to rise by reducing the supply of goods and services, leading to inflation. And as per CNN, 72% of economists expect the recession to hit the US in the middle of 2023.

What happens during a recession?

Generally speaking, when recession hits, the economy shrinks!

Recession leads to -

- Lower employment levels

- Decreases the market performance

- Deteriorates stock market results

- Increases the borrowing costs of both businesses and consumers

Although not as severe as the Great Depression, the Recession of 1937 remains one of the most significant economic downturns of the 20th century. Wikipedia

What are the measures taken by the government to curb the recession?

Central banks, such as the Federal Reserve in the United States, often use monetary policy to address inflation and recession. For example, during a recession, the central bank might lower interest rates to encourage borrowing and spending, which can stimulate the economy.

Some measures that the government can take to combat a recession include:

1. Tax cuts

Governments can reduce taxes to increase disposable income for consumers and businesses. This can lead to increased spending and investment, which can help stimulate economic growth.

2. Government spending

Governments can increase spending on infrastructure projects, such as building roads and bridges, to create jobs and increase demand for goods and services.

3. Monetary policy

Central banks can lower interest rates to encourage borrowing and investment. This can help increase spending and stimulate economic growth.

4. Support for businesses

Governments can provide financial assistance to struggling businesses to help them stay afloat during a recession. This can include measures such as loans, tax breaks, and grants.

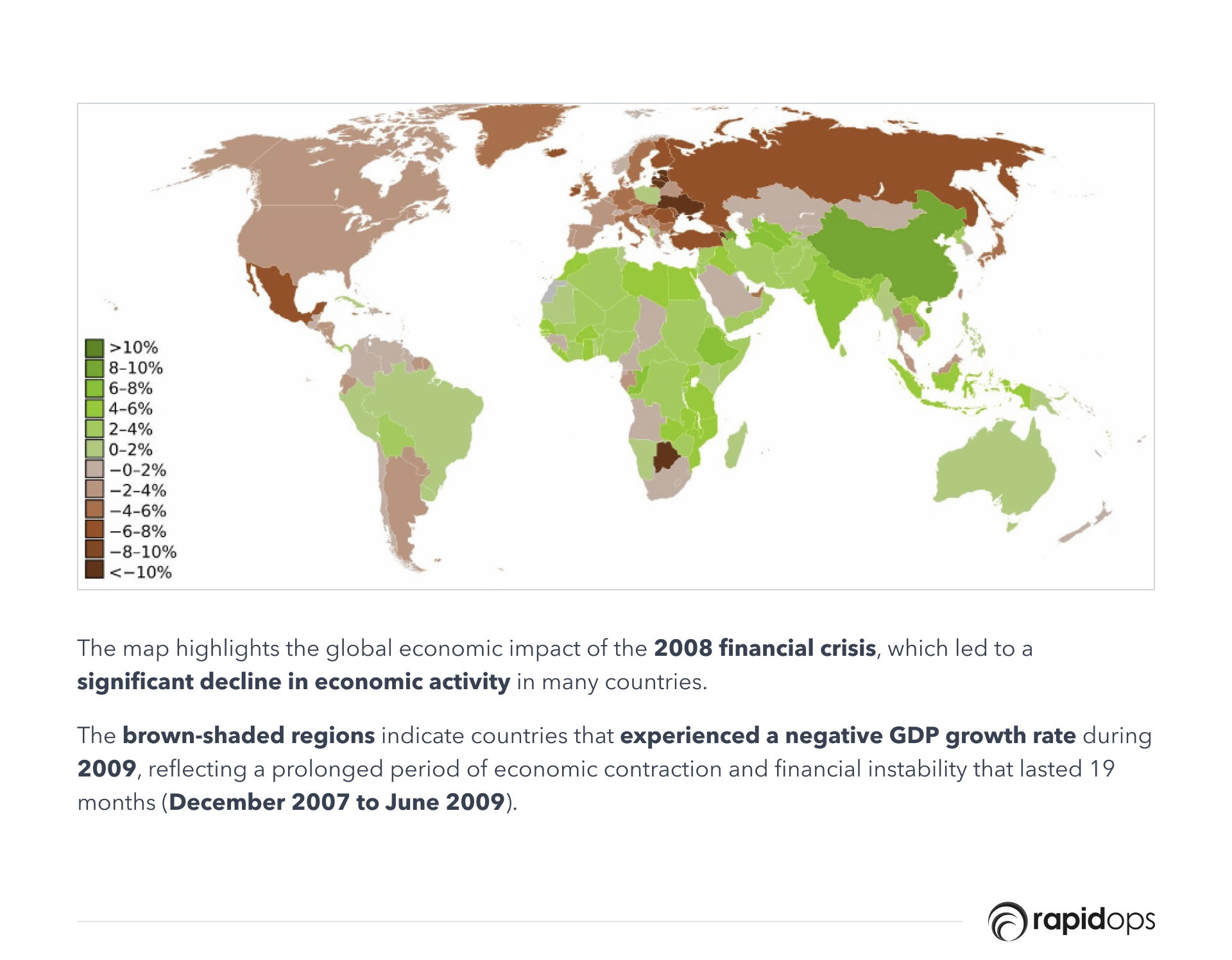

Final thoughts on the role of data and analytics in countering a recession

Source: Wikipedia

Businesses can use data and analytics to prepare for a recession by first accepting that economic downturns are a natural part of the business cycle. Businesses should use data to make informed decisions rather than panic or resort to knee-jerk reactions to help them navigate the recession effectively.

Businesses can position themselves for long-term success even in the face of economic uncertainty by -

- Understanding the key drivers of their revenue

- Optimizing their operational processes

- Identifying new growth opportunities

Remember, no business is completely recession-proof. But you can take steps to prepare for tough times by laying a strong data and analytics foundation. Building a robust data and analytics tool will act as a cherry on top that will help you curb the impact of an economic downturn with well-informed insights.

When you have access to clean and structured data and a platform that helps you derive insights from it, you can fight the recession longer. You can do so by choosing Rapidops as your go-to digital product development partner for data and analytics services.

As a trusted digital partner, Rapidops has helped businesses of all sizes streamline their data processes, improve their bottom line, and take their business to the next level with proven strategies for success.

What’s Inside

- What can business leaders do to weather the “recession storm”?

- Using data prediction models to monitor recession indicators

- Practical strategies to navigate the murky waters of recession with data and analytics

- Understanding the relation between inflation and recession

- Final thoughts on the role of data and analytics in countering a recession

Let’s build the next big thing!

Share your ideas and vision with us to explore your digital opportunities

Similar Stories

- Analytics

- undefined Mins

- July 2019

Receive articles like this in your mailbox

Sign up to get weekly insights & inspiration in your inbox.