Roofing distribution has long been a relationship-driven industry. Growth was built on trust, dependable branches, and teams who knew their contractors personally while also forming connections with new customers through hands-on interactions. Orders moved through phone calls, paper forms, and experience, with much of the work relying on judgment, memory, and coordination.

But the old ways aren’t keeping up. You’ve felt it: a contractor wants to quickly check product details, availability, or alternatives, but there’s no customer portal. Your sales rep scrambles: systems show conflicting information, branch inventories don’t match, and pricing isn’t consistent. The rep puts the contractor on hold, calls another branch, coordinates with teammates, and tries to piece together a clear answer. Sometimes the contractor has already placed the order elsewhere, while your sales team loses time that could be spent selling, advising, and driving growth.

Contractors haven’t suddenly become tech-obsessed, but their tolerance for uncertainty has dropped. Most prefer to handle things themselves without calling for every detail. They expect reliable pricing, accurate availability, and on-time deliveries, because their crews, schedules, and margins depend on it. Miss even a few, and loyalty quietly slips away, another lost order, another frustrated crew.

Distributors who continue to grow aren’t abandoning what works they’re tightening it, reducing friction, standardizing workflows, and keeping only the promises they can deliver. In a cautious, relationship-driven industry, this operational discipline is becoming the key differentiator, and this article explores exactly why these shifts matter, what’s driving change in roofing distribution, and how understanding these dynamics can help you navigate 2026 with confidence and clarity.

What is pushing roofing distribution toward change in 2026

2026 is set to redefine roofing distribution, and the pace of change is accelerating faster than ever. For leaders, recognizing the shifts quietly transforming the industry isn’t optional, it’s essential. Gaining this awareness equips you to navigate uncertainty with confidence, make smarter decisions, and position your business to stay ahead in a market that won’t wait.

1. Contractors expect faster quotes, self-service, and real-time visibility

Contractors today expect a higher level of responsiveness than ever before. They need pricing information quickly, without delays, and they want the ability to check stock and delivery schedules independently. Self-service access has become a baseline expectation, allowing contractors to place and track orders without constantly relying on your staff.

Real-time visibility into inventory, order status, and delivery timing is critical, because delays or inaccuracies directly impact jobsite productivity and contractor confidence. Meeting these expectations isn’t optional anymore; it’s essential to maintaining loyalty and repeat business.

2. Contractors themselves have evolved, they are digitally aware

Even in a traditionally conservative industry, contractors are increasingly relying on digital tools to plan projects, track materials, manage crews, and coordinate logistics. They expect distributors to integrate seamlessly with their workflows, sharing information directly from their systems without manual intervention or constant communication.

Leaders who understand this shift gain insight into how contractors operate daily, enabling smoother collaboration, faster communication, and more precise execution. Adapting distributor systems to align with contractors’ digital habits is now essential to staying relevant and responsive in a modern market.

3. Margin compression and rising operating costs

Every hour your team spends on manual processes checking orders, resolving exceptions, or coordinating across branches, quietly erodes profitability. Rising labor, inventory, and operational costs only intensify the pressure on margins. For distributors, inefficiencies are not just administrative, they directly impact the bottom line.

Streamlining workflows, standardizing processes, and improving predictability turns operational discipline into a strategic advantage. By addressing these hidden drains, distributors can protect margins, reduce costs, and position their business for sustainable growth in an increasingly competitive roofing market.

4. Increased competition

The industry is becoming more competitive as regional specialists and consolidating players improve their operations and service offerings. Contractors now compare distributors not just on personal relationships but on service reliability, availability, and operational efficiency.

Even in a traditionally conservative market, the ability to deliver consistently, communicate accurately, and provide timely digital access has become a differentiator. Staying competitive requires operational discipline, consistent service, and adoption of processes that enable repeatable, reliable performance across every branch.

5. Sales teams are spending too much time on administrative work

Sales representatives often spend a significant portion of their day on manual tasks collecting, validating, and coordinating information across branches and systems. This administrative load limits their ability to focus on contractor interactions, respond quickly to requests, and capture emerging opportunities.

Over time, the strain reduces overall team productivity, slows operational responsiveness, and can negatively affect revenue and service quality. The cumulative impact of these inefficiencies makes this challenge a major driver pushing roofing distribution toward change in 2026.

6. Limited visibility across the business constrains growth

Fragmented operations, branch-level silos, and disconnected systems create blind spots that affect everyone across your organization. When teams lack visibility into inventory, fulfillment status, or branch performance, they struggle to provide accurate information to customers, coordinate effectively, and respond quickly to issues.

Over time, these gaps increase errors, slow operations, reduce reliability, and ultimately constrain growth and overall operational performance as roofing distributors move into 2026.

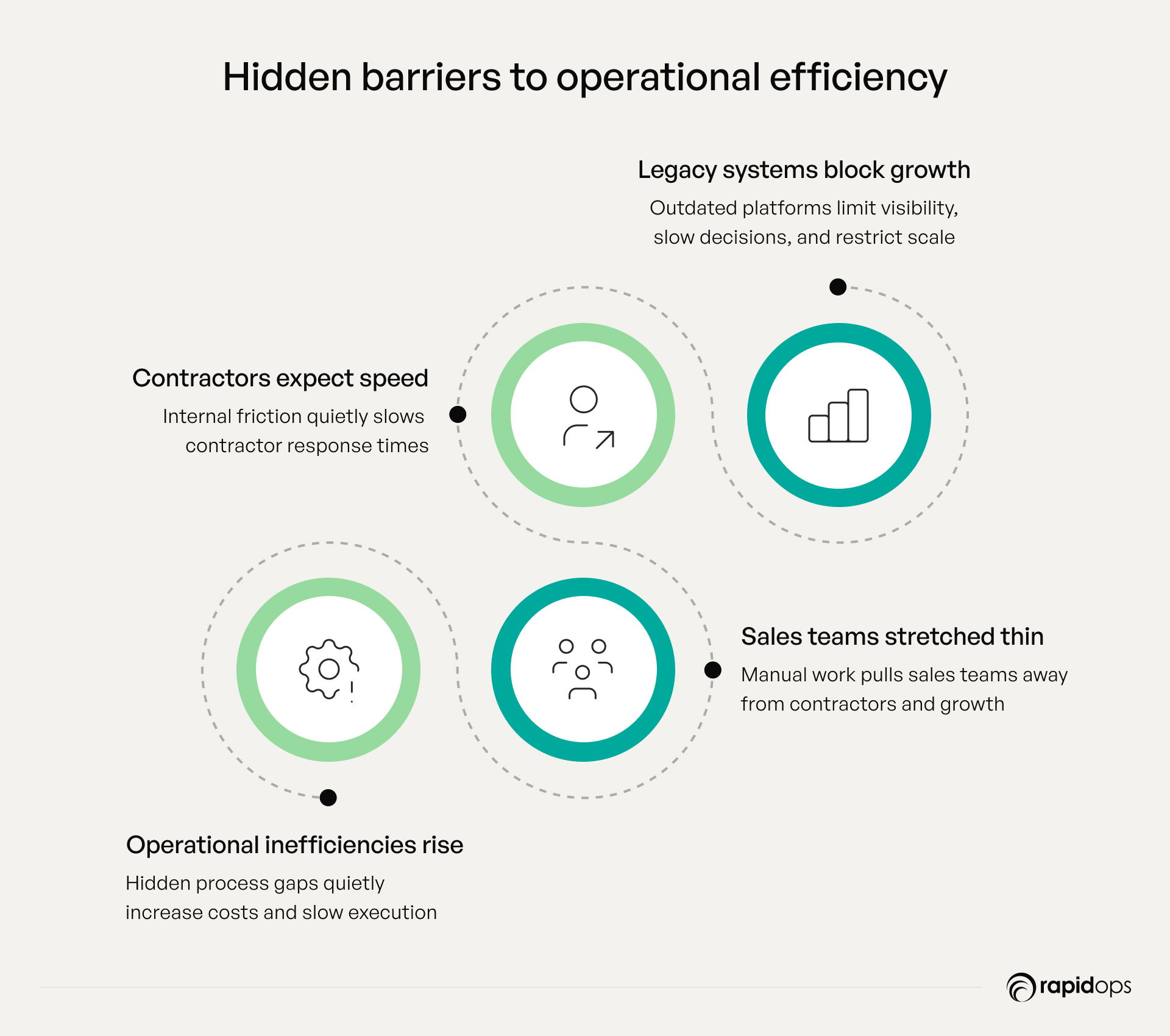

These factors together define the limits of growth for roofing distributors. Contractors’ expectations, operational inefficiencies, rising costs, and competitive pressures mean that traditional ways of working are no longer sufficient. Left unaddressed, these pressures can erode contractor loyalty, reduce margins, and slow overall growth.

Over time, even small inefficiencies, delays, or inaccuracies compound, directly affecting competitiveness, business continuity, and performance as distributors head into 2026.

How roofing distribution is actually changing

Every interaction with contractors, every movement of materials, and every workflow in your branches is quietly transforming. Roofing distribution is evolving in terms of how teams operate, the data used, and the relationships managed. Understanding these operational changes gives you the insight to act decisively, streamline processes, and capture growth while maintaining contractor trust.

Digital ordering and customer portals are becoming standard

Contractors today expect more than just fast responses, they want complete control over their ordering process. Self-service portals allow them to place, track, and manage orders independently, reducing the need for constant manual intervention. For your teams, this means fewer repetitive tasks and more time to focus on high-value interactions and problem-solving. Understanding how contractors interact with these tools helps you design workflows that enhance speed, accuracy, and responsiveness, directly impacting contractor satisfaction and loyalty.

When your operations align with these expectations, you also position your business as forward-thinking and reliable. By enabling seamless digital interactions, you demonstrate that you understand your contractors’ day-to-day realities, while simultaneously freeing your teams to drive strategic growth and deeper engagement, rather than just handling routine tasks.

Pricing, inventory, and order visibility are moving closer to real-time

In a fast-moving industry, contractors demand certainty at every step, accurate pricing, reliable stock levels, and precise delivery schedules. Achieving this requires integrated systems, centralized data, and consistent processes across all branches. For you, having real-time visibility means your team can anticipate potential bottlenecks, resolve issues proactively, and communicate confidently with contractors, enhancing trust and operational efficiency.

Beyond operational benefits, real-time visibility is a strategic tool for decision-making. By monitoring trends and patterns, you can adjust inventory, plan deliveries more accurately, and optimize resource allocation. This ability not only reduces errors but positions your business to meet contractor expectations consistently, setting you apart in an increasingly competitive market.

Sales teams are focusing more on relationship-building

With routine administrative work automated, your sales representatives can shift focus from processing orders to building relationships. This allows them to understand contractor needs deeply, anticipate challenges, and provide proactive solutions. When your teams engage strategically, rather than reactively, they become trusted advisors rather than just order managers, driving both loyalty and repeat business.

Empowering your sales teams in this way also strengthens your operational effectiveness. By freeing them from repetitive tasks, you ensure that your most valuable resource, your people, can contribute to growth and long-term client satisfaction, enhancing your competitive advantage while reinforcing trust at every interaction.

Data-driven forecasting, purchasing, and margin control

Data is now the backbone of strategic decision-making. Insights from orders, inventory, and purchasing trends allow you to forecast demand accurately, optimize procurement, and control margins. When you use data effectively, decision-making shifts from reactive to predictive, enabling you to mitigate risks, reduce inefficiencies, and maximize profitability.

Additionally, data transparency empowers your teams to act confidently. By analyzing patterns and trends, you can identify operational gaps, plan proactively, and align resources where they’re needed most, strengthening both contractor satisfaction and overall performance. Executives who leverage this insight position their organizations to thrive in 2026, even as complexity increases.

Technology supporting, not replacing, relationships

Technology is no longer a replacement for human interaction, it’s a force multiplier. Automated alerts, workflow platforms, and digital portals allow your teams to respond faster, resolve issues efficiently, and maintain consistent service standards. At the same time, the human touch, your expertise, guidance, and trust remains central to contractor satisfaction.

For you as a leader, understanding this balance is critical. When technology supports your teams rather than replacing them, contractors feel valued and supported, and your business benefits from enhanced efficiency, higher loyalty, and sustainable growth. Achieving this alignment is a hallmark of modern, forward-thinking distributors.

Standard mundane work is becoming automated

Repetitive tasks like order entry, inventory updates, and scheduling are increasingly automated, freeing your teams to focus on high-impact work that drives growth. Automation reduces errors, ensures consistency across branches, and allows your people to dedicate time to contractor engagement, process improvement, and strategic planning.

From a leadership perspective, this shift transforms operations into a reliable, predictable, and scalable engine. The efficiencies gained through automation aren’t just incremental, they compound over time, enabling your organization to respond faster, maintain higher standards, and compete effectively in a rapidly evolving market.

Collectively, these drivers show that traditional approaches are no longer sufficient. Contractors’ expectations, operational pressures, digital adoption, and competitive dynamics are reshaping roofing distribution. By understanding these shifts, you gain the foresight, awareness, and perspective needed to prioritize investments, guide teams strategically, and capitalize on opportunities before they become critical challenges.

The distributors who grasp these forces today will not just survive 2026, they will thrive, turning change into a lasting advantage and reinforcing contractor trust, operational excellence, and market leadership.

What these changes mean for growth

The operational changes reshaping roofing distribution are not incremental improvements; they are altering how growth is created, sustained, and defended. Growth is increasingly driven by execution quality, decision speed, and capital discipline rather than footprint expansion alone. Leaders who understand these shifts can unlock scale without compounding complexity, while those who rely on legacy growth levers face diminishing returns.

Growth no longer comes only from adding branches

Branch expansion used to be the primary growth engine because it increased physical proximity to contractors and inventory. Today, operational reach matters more than physical reach. When pricing, inventory, and order execution are visible and reliable across locations, growth can be generated by serving existing markets more effectively rather than entering new ones.

This shift means growth is increasingly tied to how well each branch performs, not how many branches exist. Leaders are focusing on improving fill rates, reducing service friction, and increasing order velocity within their current footprint. The ability to consistently deliver accurate pricing, dependable availability, and predictable fulfillment creates growth density, more revenue per market, per branch, and per account, without the overhead and risk of constant expansion.

Better utilization of your sales team

Sales productivity is changing from activity-based to outcome-based performance. When sales teams no longer spend time checking inventory, validating pricing, or correcting order issues, their capacity shifts toward higher-impact work relationship depth, account expansion, and proactive engagement.

This improves growth in two ways. First, the same sales headcount can manage more revenue without burnout. Second, sales interactions become more strategic, focusing on contractor planning, job timing, and long-term volume rather than transactional firefighting. Better utilization turns sales teams into growth multipliers instead of order intermediaries, directly increasing revenue per rep and strengthening account loyalty.

Ability to scale the business without scaling headcount

Operational scalability is becoming a defining growth advantage. As workflows standardize and routine tasks automate, transaction volume can increase without a linear increase in people. This changes the economics of growth.

Instead of adding staff to manage complexity, leaders are reducing complexity itself, through clearer workflows, system-driven execution, and shared operational visibility. The result is a business that can absorb demand spikes, seasonal fluctuations, and market expansion without straining teams or inflating operating costs. This form of scale protects margins while enabling growth, a balance that traditional expansion models struggle to achieve.

Faster sales cycles and higher share of wallet

Speed is becoming a competitive growth lever. When contractors receive immediate clarity on pricing, availability, and delivery timelines, purchasing decisions happen faster and with more confidence. Reduced friction shortens the sales cycle and increases order frequency.

At the same time, reliability drives consolidation. Contractors concentrate spending with distributors who reduce uncertainty and operational risk. This leads to a higher share of wallet not through discounting, but through consistency and ease of doing business. Faster cycles combined with deeper account penetration create compounding growth without aggressive acquisition tactics.

Improved customer retention and operational stickiness

Retention is increasingly tied to operational trust rather than pricing alone. When systems support accurate orders, predictable fulfillment, and responsive service, contractors integrate the distributor into their own workflows. This creates operational dependency; switching becomes costly not financially, but operationally.

Stickiness grows as distributors become embedded in how contractors plan jobs, manage materials, and meet deadlines. This reduces churn, stabilizes revenue, and increases lifetime value. Growth becomes less about replacing lost accounts and more about expanding durable, long-term relationships.

Better capital allocation and inventory efficiency

Growth without capital discipline creates fragility. The shift toward data-informed forecasting and purchasing allows leaders to align inventory with real demand patterns rather than assumptions or historical averages.

Improved inventory turns free up working capital, reduce write-offs, and improve cash flow. Capital can then be allocated toward strategic investments, technology, service improvements, or selective expansion, rather than being trapped in excess stock. This creates a more resilient growth model where profitability and scale reinforce each other instead of competing.

The cost of not adapting

Even small, unseen risks in your operations quietly undermine margins, slow growth, and weaken contractor trust. Recognizing this cost is critical for executives, as it highlights the stakes of inaction, helping leaders understand the value of safeguarding revenue, strengthening relationships, and keeping their distribution business competitive, resilient, and future-ready.

Operational inefficiencies compounding over time

When processes remain manual or fragmented, small inefficiencies accumulate into significant operational drag. Delayed approvals, duplicate data entry, inconsistent inventory tracking, and reactive exception handling quietly consume your teams’ time and resources. Over time, these inefficiencies reduce throughput, increase operational costs, and make scaling the business more difficult. Leaders who fail to address these compounding inefficiencies find that even small process gaps can erode margins and limit growth potential.

Sales teams are stretched thin by manual work

Your sales teams are a critical growth engine, but when they spend hours chasing paperwork, validating orders, or correcting errors, their focus on building contractor relationships is reduced. Stretched teams mean slower response times, missed opportunities, and less strategic account management. The result is lower customer satisfaction, reduced share-of-wallet, and a workforce that becomes reactive rather than proactive, ultimately limiting your competitive edge.

Customers quietly moving to more responsive distributors

Contractors notice operational friction faster than most executives realize. Delayed deliveries, unclear stock levels, and slow responses push them toward distributors who provide transparency, reliability, and convenience. The cost isn’t always immediate, it often shows up as quietly declining repeat business and shifting loyalty. Without proactive adaptation, your best customers may gradually migrate to competitors who can meet expectations with more speed and consistency.

Legacy systems becoming growth bottlenecks, not just IT issues

Outdated ERP, WMS, or branch-level systems aren’t just IT concerns, they actively constrain growth. When systems can’t provide real-time visibility into pricing, inventory, or delivery status, your teams operate in the dark, decision-making slows, and errors increase. These bottlenecks limit your ability to scale efficiently, adopt automation, or leverage predictive insights. In essence, what once supported your operations now holds them back, turning technology from an enabler into a barrier to growth.

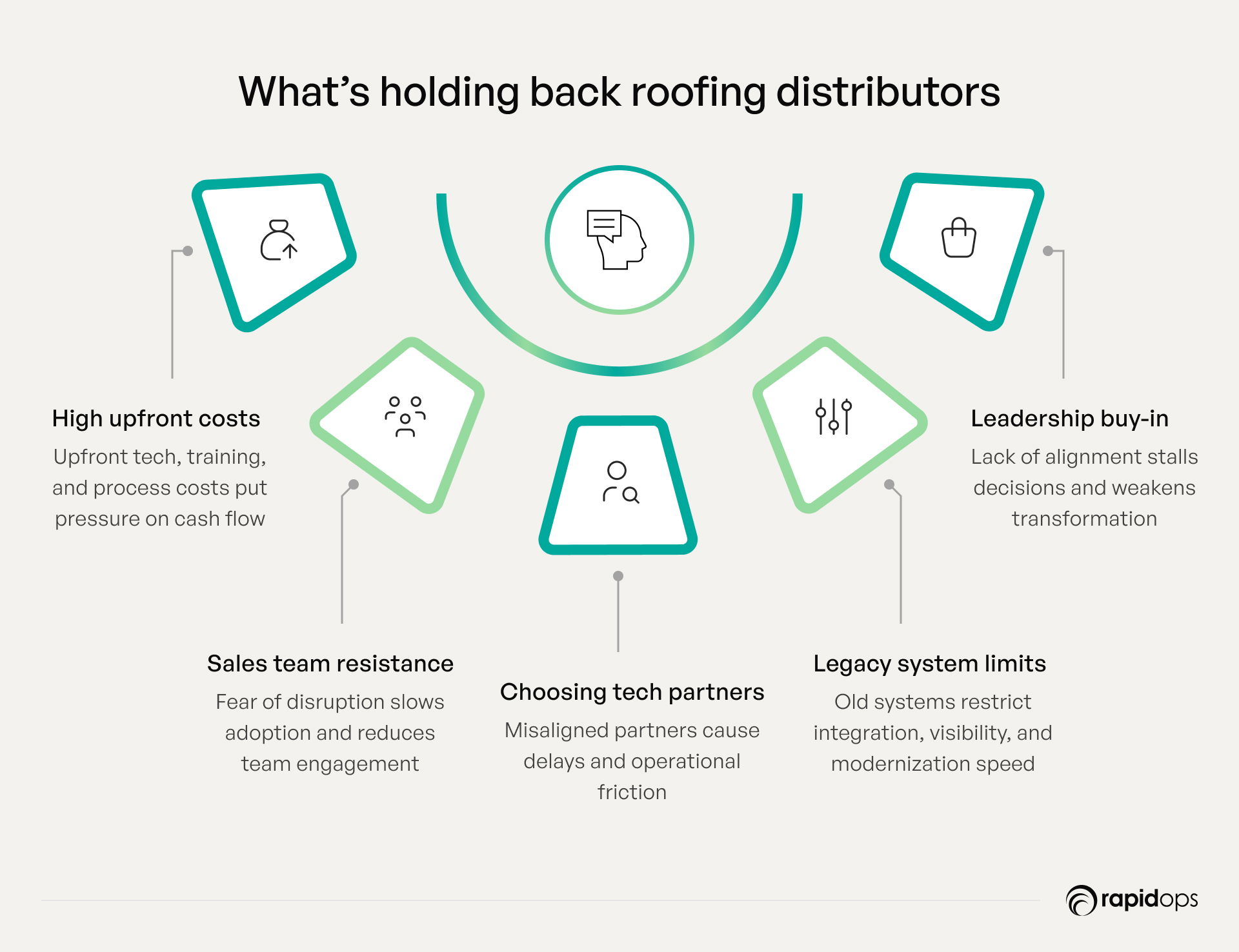

Key challenges facing modern roofing distributors

As you modernize your roofing distribution business, you encounter operational, financial, and organizational pressures that directly impact margins, contractor relationships, and growth. Failing to anticipate these modernization challenges can result in costly delays, resistance from teams, and missed opportunities. Understanding them upfront equips you to lead change confidently and make high-impact decisions in 2026.

1. High initial budget

Modernization demands a significant upfront financial commitment. Beyond acquiring new software or automation tools, costs include workforce training, process redesign, and transitional operational adjustments that can temporarily slow daily operations. For many distributors, the total expenditure can strain cash flow, divert resources from other initiatives, and create internal pressure on financial decision-making. Recognizing the full scale and complexity of this investment is essential to understanding the challenges modernization brings.

2. Sales team resistance

Your sales teams may perceive modernization as a threat to their roles or a disruption to their established workflows. Myths that technology will replace human roles, discomfort with new systems, or fear of losing control over customer relationships can create resistance. This behavioral challenge can reduce adoption rates, lower engagement, and create friction across teams. Understanding this cultural dimension is critical, as workforce perceptions directly influence the success and momentum of modernization efforts.

3. Finding the right technology partner

Selecting an experienced and compatible technology partner is a complex challenge. Partners lacking understanding of roofing distribution workflows, branch-level operations, or field-driven sales processes can introduce delays, misaligned expectations, and integration difficulties. These misalignments can amplify operational friction and create uncertainty throughout the modernization process. Fully grasping this challenge highlights how critical vendor compatibility and industry expertise are to the transformation journey.

4. Legacy system compatibility

Many distributors rely on ERP, WMS, or accounting systems that may not fully support modernization. Inflexible architectures, limited integration capabilities, or outdated functionality can result in data silos, reduced operational visibility, and slowed workflows. These system constraints often become bottlenecks during modernization, creating technical challenges that require careful understanding. Appreciating the limitations of existing systems is essential to grasp the complexity of adopting modern technologies.

5. Leadership buy-In

Achieving full leadership alignment is another significant challenge. Conflicting priorities, unclear ownership, or partial engagement from executives can stall projects, create budget disputes, or disrupt adoption. Leadership dynamics are pivotal because modernization requires coordinated decision-making, clear accountability, and consistent support to navigate operational, financial, and technological complexities. Lack of alignment can significantly increase the difficulty of executing transformation initiatives effectively.

Each of these challenges financial investment, cultural resistance, technology partner alignment, legacy system limitations, and leadership buy-in, shapes how successfully your modernization unfolds. Recognizing them in detail helps you navigate obstacles strategically, maintain momentum, and ensure your business emerges more resilient, efficient, and positioned for sustainable growth.

From complexity to clarity

Running a roofing distribution business today is no easy task. Between late deliveries, complex workflows, inventory pressures, and the constant push to adopt new technology, executives face challenges that can quickly impact margins, contractor relationships, and overall growth. Understanding these challenges is the first step to turning them into opportunities.

At Rapidops, we’ve spent years working alongside distributors as they navigate this shift, building digital solutions that reflect how their businesses actually run. We understand the realities of roofing distribution: branch-level operations, field-driven sales workflows, and the limits of legacy ERP systems. That’s why our approach focuses on extending and connecting what you already have, not forcing a risky rip-and-replace that disrupts operations or slows growth.

If you’re unsure where operational friction is quietly holding growth back, a one-on-one conversation can help clarify what to fix first. Schedule a call with one of our experts to review your current workflows and identify practical, low-risk next steps.

Frequently Asked Questions

What does “modern distribution” actually mean in today’s roofing market?

Modern distribution is about running a roofing business where growth doesn’t create friction. It’s not just about adopting new technology it’s about operational clarity, real-time visibility, and seamless workflows that connect inventory, orders, pricing, and customer data across branches. A modern distributor can scale operations, respond quickly to customer needs, and make data-driven decisions without relying on spreadsheets, workarounds, or siloed processes. Essentially, it’s about designing a system where efficiency, accuracy, and scalability are built into daily operations, allowing growth to happen smoothly rather than chaotically.

How are contractor and builder expectations changing in 2026?

Contractors and builders today don’t just want materials, they want certainty. In 2026, they expect fast responses, accurate information, and reliable delivery every time they place an order. Even small delays or inconsistencies can disrupt projects and erode trust. Distributors who proactively communicate, anticipate needs, and simplify processes not only meet these expectations but also strengthen relationships. Success now comes from embedding clarity, predictability, and efficiency into every workflow so customers feel confident and supported.

How do I know if our current systems are holding us back?

Your systems may be limiting growth if everyday operations require workarounds, manual updates, or excessive cross-checking. Signs include delayed decision-making, inconsistent data between branches, slow order fulfillment, or teams spending more time fixing problems than serving customers. If adding a new branch, product line, or sales channel creates disproportionate complexity, it often indicates that current systems cannot scale effectively. Evaluating system limitations involves identifying where friction is highest and mapping those pain points to growth objectives, so leadership can see clearly which areas need modernization.

Is it possible to modernize operations without replacing existing systems?

Yes, modernization does not always require replacing ERPs or legacy systems. Most successful distributors focus on extending, connecting, and optimizing what already works. This can mean integrating additional tools for workflow automation, improving visibility across branches, or centralizing data to reduce manual intervention. By enhancing existing systems instead of ripping them out, distributors can deliver operational improvements faster, reduce risk, and avoid disruption, while still achieving the clarity and efficiency needed for growth.

How do distributors prioritize what to fix first when everything feels complex?

Prioritization begins with identifying areas that create the most friction for both customers and internal teams. Common starting points include bottlenecks in order processing, inventory visibility, pricing consistency, or cross-branch coordination. Addressing one high-impact area first often creates momentum, clarifies other operational pain points, and reduces downstream issues. The key is to tackle improvements in manageable, incremental steps, focusing on changes that deliver measurable value and immediate operational clarity, rather than attempting to solve everything at once.

Rahul Chaudhary

Content Writer

With 5 years of experience in AI, software, and digital transformation, I’m passionate about making complex concepts easy to understand and apply. I create content that speaks to business leaders, offering practical, data-driven solutions that help you tackle real challenges and make informed decisions that drive growth.

Let’s build the next big thing!

Share your ideas and vision with us to explore your digital opportunities

Similar Stories

- Transformation

- undefined Mins

- March 2022

- Transformation

- undefined Mins

- March 2020

Receive articles like this in your mailbox

Sign up to get weekly insights & inspiration in your inbox.